Azevêdo informa de una ligera disminución de las restricciones al comercio y exhorta al G-20 a tomar la iniciativa en el programa posterior a Bali

En el informe de la OMC sobre las medidas comerciales del G-20, publicado el 18 de junio de 2014, se dice que “los miembros del G-20 establecieron 112 nuevas medidas restrictivas del comercio en el período de mediados de noviembre de 2013 a mediados de mayo de 2014, algo menos que las 116 nuevas medidas restrictivas introducidas en el período anterior, de mediados de mayo a mediados de noviembre de 2013”. El Director General Roberto Azevêdo dijo que “está claro que a lo largo de este período se ha seguido acumulando una capa de restricciones al comercio … que no ayudará a nuestros esfuerzos por apoyar el crecimiento y el desarrollo en todo el mundo, por lo que tenemos que estar alerta”.

(de momento sólo en inglés)

> Resumen conjunto de las medidas comerciales y de inversión del G-20 (OCDE/OMC/UNCTAD)

> Informe de la OMC sobre las medidas comerciales del G-20

> Resumen y situación de las medidas comerciales y relacionadas con el comercio del G-20 desde octubre de 2008 (formato Excel)

> Informe de la OCDE/UNCTAD sobre las medidas de inversión del G-20

“Over the six months to May, G-20 members have continued to introduce trade restrictions — albeit at a slightly slower rate than before,” said WTO Director-General Roberto Azevêdo. “While some liberalising measures have also been introduced, it is clear that the coat of trade restrictions has grown a bit thicker over this period. This will not help our efforts to support growth and development around the world — and therefore we must remain watchful,” said DG Azevêdo. “One way to reverse this trend is to make progress on the WTO’s post-Bali agenda, aiming at two things: full implementation of the Bali decisions and rapid conclusion of the Doha round negotiations. On these issues, as on so many others, the leadership of the G-20 will be essential.”

Resumen del informe de la OMC sobre las medidas comerciales del G-20

(de mediados de noviembrede 2013 a mediados de mayo de 2014)

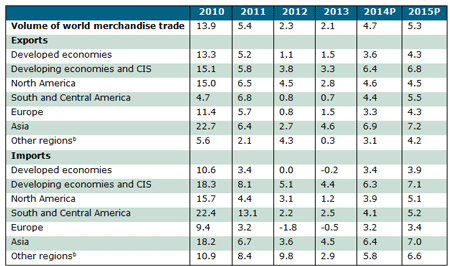

World trade growth in 2014 is expected to be higher than in 2013, but below the historical average

World trade and output have continued to grow inconsistently since the December 2013 G-20 trade report, with expansions in the fourth quarter of 2013 followed by setbacks in the first quarter of 2014. If the most recent GDP growth forecasts hold, the volume of world merchandise trade is expected to grow by 4.7% in 2014 and by 5.3 % in 2015, significantly larger than in 2013. The projection for 2014 is below the 5.3 % average of the last 20 years and the 6% average of the 20 years leading up to the financial crisis. Most of the risks to this trade outlook are on the downside.

Table 1 World merchandise trade volume by region and level of development, 2010-2015a

Annual percentage change

a Figures for 2014 and 2015 are projections.

b Other regions comprise the Africa, CIS and the Middle East.

Sources: WTO Secretariat.

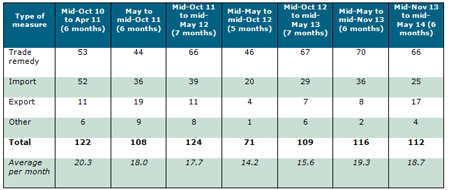

G-20 members continue to introduce trade restrictions, but at a slightly slower rate

G-20 members put in place 112 new trade restrictive measures during the period mid‑November 2013 to mid-May 2014 — slightly down from the 116 new restrictive measures introduced in the previous period from mid–May to mid-November 2013. As in the past, trade remedy actions account for more than half of the number of new restrictive measures applied during the period under review. New import restrictive measures applied by G-20 members during the period under review affect 0.2% of world merchandise imports or 0.3% of G-20 merchandise imports.

Table 2 Trade restrictive measures

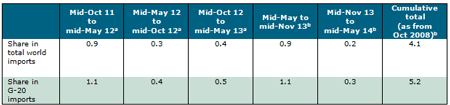

The trade coverage of import restrictive measures implemented by G-20 economies during the review period was estimated at 0.2% of world merchandise imports, or the equivalent of 0.3% of G-20 merchandise imports (Table 3).1

Table 3 Share of trade covered by import restrictive measures

(per cent)

The vast majority of trade restrictive measures taken since the global financial crisis remain in place

1,185 trade restrictive measures have been recorded since October 2008, with only 251, or roughly one-fifth, of these having been removed by mid-May 2014 making the total number of measures still in place 934 – up by 78 from the end of the last reporting period. The relatively low removal rate and the continuing addition of new restrictive measures have resulted in a continuing upward trend. Looking specifically at import restrictive measures, excluding those measures that have been reported as terminated, they are estimated to cover around 4.1% of world merchandise imports and around 5.2% of G-20 imports.

Encouragingly, the number of trade liberalizing or facilitating measures has increased

As in the past, the number of trade restrictive measures applied by G-20 members during the period under review exceeds the number of liberalizing measures. However, the number of liberalizing measures taken during this period is significantly larger than in the previous period both in absolute and in relative terms. The number of such measures taken in the most recent period is 93, compared with 57 in the period mid-May to mid-November 2013. The liberalizing measures now represent a larger share of all recorded measures (45%) than in the previous period (33%). Looking at import facilitating measures introduced during the period under review, they cover around 0.4% of world merchandise imports or 0.6% of G-20 merchandise imports.

Lack of information persists in respect of certain types of measures

Although the information presented in this report covers a wide range of measures affecting trade in goods and services, the observations made in the December 2013 G-20 trade report on the lack of adequate data regarding certain types of measures remain valid. This is the case in particular with respect to subsidies and other support measures. As reflected in Annex 2 to this report, the information made available by G-20 members on such measures is very limited. How to ensure greater transparency with respect to subsidies and other types of behind-the-border measures is an important matter that requires further attention.

The important role of the G-20 members in reinvigorating the multilateral trading system

The multilateral trading system remains the best defence against protectionism and an important driver of economic growth, sustainable recovery and development. The successful outcome of the WTO’s 9th Ministerial Conference has provided an important opportunity to strengthen and reinvigorate the multilateral trading system. Implementation of the decisions reached in Bali and developing a work programme by the end of this year on the conclusion of the Doha Development Agenda are the next steps in strengthening the multilateral trading system. This will deliver a boost to trade around the world and help to alleviate the concerns regarding obstacles to global trade flows. It will also help to deliver global growth, though protectionist pressures are bound to remain in a context of slow uneven recovery and persistent high levels of unemployment. G-20 members need to remain vigilant and show leadership in combatting such pressure.

Notes:

1. “Trade coverage” as used in this section means the value of imports of the product from countries affected by the measure as a share of either the total value of total world merchandise imports or the total value of merchandise imports by G-20 members. Back to text